18 Sep More on Alphabet and the Startup Studio model

Let’s talk about Alphabet. Larry Page stunned us all last month when he announced the restructuring of Google’s business model in a blog post. Alphabet is to act as a holding company for Google’s portfolio, separating out different businesses in alignment with the purpose of each. This is not just a rebranding, it goes much deeper.

Branding

Consider the name they’ve chosen, Alphabet. Larry and Sergey really wanted to create a clear separation between the new holding company and the Google of old. Instead of simply restructuring the company and calling the holding company something like Google Corp, Sergey and Larry have made a very clear distinction by introducing a completely new name. Now, when you hear Alphabet you know to think of the parent company. Likewise, now when you hear Google, you know to reference its group of internet companies like Search, and YouTube. Additionally, by choosing Alphabet, they are intent on showing that they are more than just Google. They go from A to Z, and all the different ideas that can be created with those 26 letters.

Alphabet vs. Laicos

For me, the news of Google’s restructuring sure hit close to home. Certainly there are similarities between Laicos’ Startup Studio business model and Alphabet’s. Sure, we’re nowhere near the massive size that they have achieved. For us, the reasons to pursue this model include walling off risk, allowing us the freedom to innovate rapidly, and to diversify our products to attract different investors. It also allows us to quickly sell off an asset in an acquisition, where Laicos still remains the beneficiary. The structural benefits for a nimble, growing company like Laicos are immense when you think about what we aim to achieve.

Being a Startup Studio means that we develop ideas into products and products into companies. We’re lean and the ability to quickly innovate, build and test new products gives us much more flexibility than a traditional rigid startup model. If we spend a small percentage of our staffing and resources on a project that we fall out of love with after a few weeks, then we archive it and allocate those resources to something more promising. The ability to prototype and fail quickly is a key component of the Lean methodology we live by. Startup Studios minimize risk and allow us to be flexible and innovative. This model gives us the ability to focus on finding out exactly what works and what doesn’t. The obvious size difference between Laicos and Alphabet should also illustrate just how scalable this type of structure really is. Google, or should I say Alphabet, doesn’t need to attract investors at this stage of the game. They are fully funded and profitable. Although their aspirations and circumstances differ from ours, it is clear that they decided on this type of structure for good reasons. Laicos, too, will be a publicly traded company some day.

Benefits

This leads us to examine the reasons behind the change. The broad range of companies under the Google brand name had obviously strayed from the original Search engine and Ads business. This restructuring allows for each of the companies under the Alphabet umbrella to enjoy more autonomy and focus on their individual missions. Importantly, this also allows their moonshot factory, Google X, to charge ahead with new innovations without upsetting risk-averse shareholders who want to take safer bets on more traditional revenue models like Search and Ads.

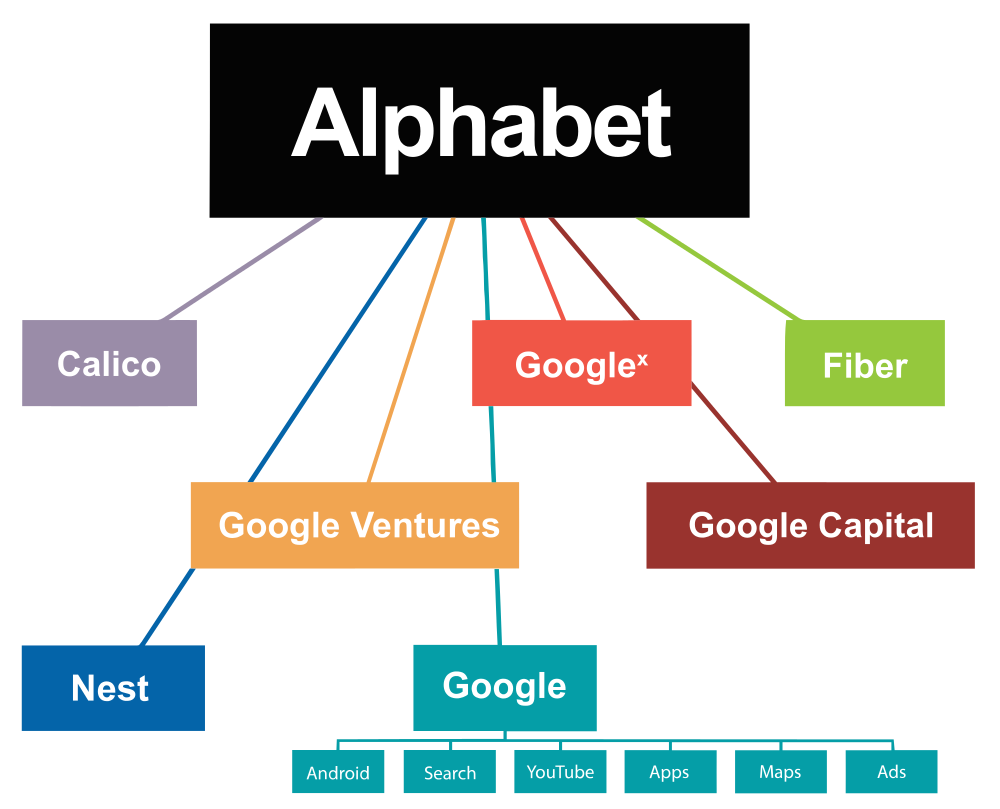

Here’s a quick breakdown of the companies that will be under the Alphabet umbrella:

Google is the largest and most well-known entity in the bunch. This is the company most people typically think of when they hear Google. It is a collection of internet companies that include Search, Android, YouTube, Apps, Maps, and Ads.

Nest Labs is Alphabet’s contender in the home automation space. Its products include the energy conserving Nest Learning Thermostat, smoke detector Nest Protect, and home security camera system, Nest Cam (formerly known as Dropcam). Nest focuses on the internet of things and its products are programmable and Wi-Fi enabled.

Calico is an R&D biotech company focused on understanding human aging. Calico researches molecular biology, genetics, and medicine. This group is responsible for bringing Google’s knack for innovation to life sciences. Calico is intent on improving human health and currently has partnerships and projects aimed at curing cancer and researching age-related diseases.

Google Fiber is Google’s broadband internet division that specializes in high-speed 1 Gigabit internet. So far, Fiber’s activities and the threat of expansion to a growing geographic area have been fairly disruptive to the ISP space. Since the ISP’s have been slow to provide faster internet speeds to the communities they serve, Fiber’s Gbit/s offerings have forced the competition to increase their own service.

Google X is known as Google’s moonshot factory. Think of a moonshot as a ground-breaking technology that addresses big problems and has no expectations of turning a profit in the near future. Google X’s projects include the driverless car, Google Glass, and Project Loon (using balloons to bring internet service to out of the way locations).

Google Ventures is Alphabet’s venture capital fund that invests in early stage companies. Its portfolio consists of over 300 companies and includes Uber, Nest, and Slack.

Google Capital is also a venture capital fund, but it is focused on investing in later stage companies, whereas Ventures is interested in early stage companies.

Financial benefits

Now for a look at how Alphabet’s stock has been faring in response to the big announcement. The day before Larry’s blog post, August 10, we saw that GOOG closed at $633.73 with a volume of 1,526,400 trades. The day of the announcement the volume surged to 5,000,900 trades and the stock price went up to $660.78 at closing.

Let’s put that into perspective. The company gained about $30B in market share the very next day. I thought that was crazy considering it was in response of a name change. Typically, whenever I observe a rebranding or pivot, I notice a loss in value. The news about the restructuring for Google/Alphabet, however, instilled confidence in investors and made the stock even stronger.

The creation of Alphabet was a strong affirmation of our own business model. There are differences in why it works for us, and why it will work for Alphabet and many of those are rooted in where each of the companies are in their growth cycle. We did it to allow easy allocation (and reallocation) of resources, mitigate risk and allow flexibility. Alphabet had reasons that included increased autonomy among individual brands and ‘silo-fication’ of new innovations. Despite the differences, the holding company business model will serve us both well and positions Laicos for similar greatness achieved by Google, now known as Alphabet.

I’m happy to hear your thoughts on the topic, so, please leave your comments below.